The Generation of Renters

A growing number of people in the UK are stuck in the rent trap. Figures from the most recent National Census have shown that in the decade from 2001 to 2011 the proportion of those owning a home fell for the first time down to 65%. Reasons for this include rising house prices, tightening credit availability and many not being able to save up for a big enough deposit whilst paying for rent and bills.

However the market is recovering and there are signs that first time buyers are beginning to make their way onto the ladder again. Even in London, where prices are increasing at a faster rate than elsewhere in the country, the CML (Council for Mortgage Lenders) has reported that mortgage lending was up 29% for first time buyers in London in the first quarter of 2014, compared to the previous quarter.

You can take steps to avoid being part of ‘ Generation Rent’ and here are just some of the reasons why you should aim for owning your own home.

1. See your investment grow

- The property market has bounced back and prices are rising. According to the Land Registry house price index (which is based on sold prices), the average price of a house has increased 6.7% in the last year. Prices in London are increasing faster than elsewhere in the country at 17%. However in other parts of the country they are also increasing. In Yorkshire for example they have increased 5.5% in the last 12 months. So you could have seen your £200,000 property increase in value by £11,000 in the space of just one year.

The chart below shows the Land Registry Price index and prices rising over the last year. The index began in 1995 (at 100) and it scores increases in residential property prices since that date.

Now is a great time to buy before prices increase further. If property prices continue to increase at their present rate or even if the rate of increase steadies a little, you could see your investment increase significantly over the next 10 years. Why rent and see someone else benefit from increasing value of your home?

2. Build up equity and see you mortgage repayments fall

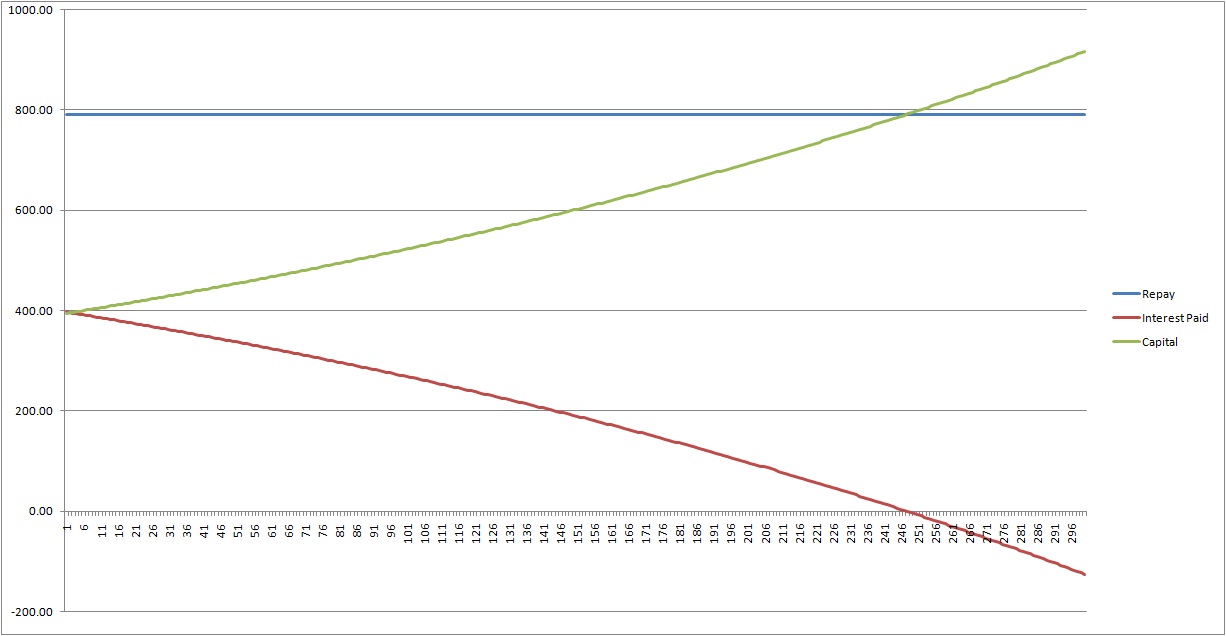

– if you have a repayment mortgage you will be paying off both interest and capital. When you first start paying off your mortgage, a lot of the repayment will be interest. However as the mortgage begins to be paid off the amount of interest you are charged will reduce. You can look around for the best mortgage deals and switch to the best deals available as they will change over time. The mortgage interest comparred to capital repaid looks like this:

3. Mortgage availability

competition has been increasing for mortgage providers and this has exerted pressure to increase mortgage availability and attractiveness.

4. Home ownership is cheaper than renting

- According to research carried out by Halifax, the cost of owning an average home in December 2013 was 16% cheaper than the cost of renting. This means it is £1,500 more a year to rent an average 3 bedroom home than to buy one. Also don’t forget with renting there are hidden costs. Landlord’s often add on other costs such as those of a credit check and admin fees. Also there is no guarantee you will get your deposit back when you leave. With home ownership you can see the value of your deposit rise as your property increases in value.

5. Make it your own

– when you own your home you can decorate it to make it exactly how you want it, make home improvements, change the garden (if you have one) and not have to worry about unwelcome visits from the real boss of your home – your landlord. You will get more stability from owning your home and more control over the way in which you live.

6. Overcome stumbling blocks

as one of the biggest hurdles to home ownership is saving for a deposit why not buy with someone else? You can pool your deposits and share mortgage repayments, helping you to get on the ladder. Work out how much you have, how much more you can save and then consider buddying up and sharing a mortgage with another person.

Author's sign off

The Genration of Renters is slowly creeping in and although we aspire to own our home, we are seemingly being priced out of this ever happening. Clever First Time Buyers are now taking the initiative and joining forces to share a mortgage, deposit, house and get off the the rental market and onto the property market. With property prices going up at the rate they are, in a few years time, you'll have made enough money to go it alone.

For more information on how you can Share a Mortgage email help@shareamortgage.com.

Read other recent articles:

2. Leaving a shared ownership property

3. Cohabitation Agreement is Essential for Unmarried Couples Divorcees forced to rent