Rent or Buy? (or To Rent or not To Rent...)

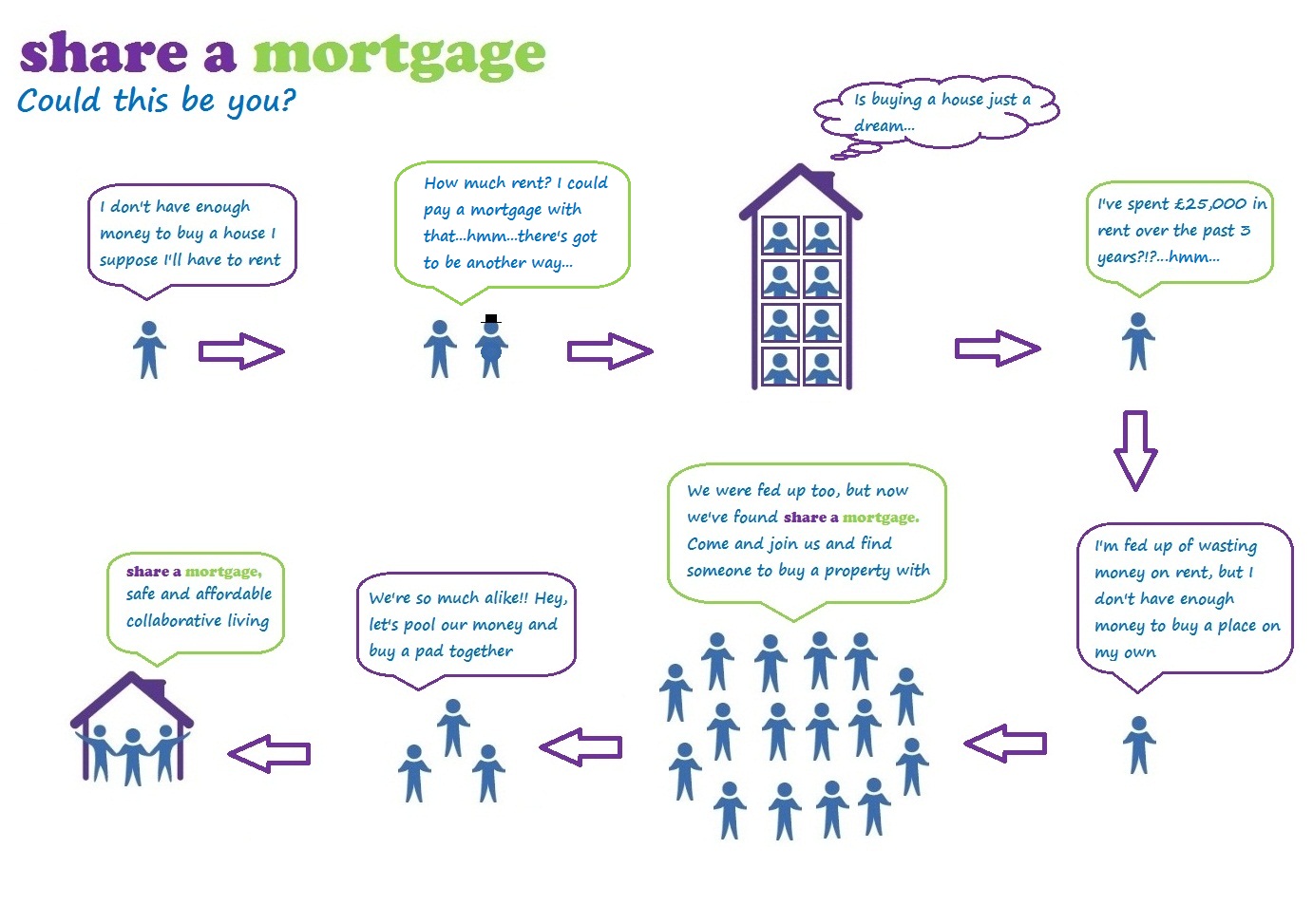

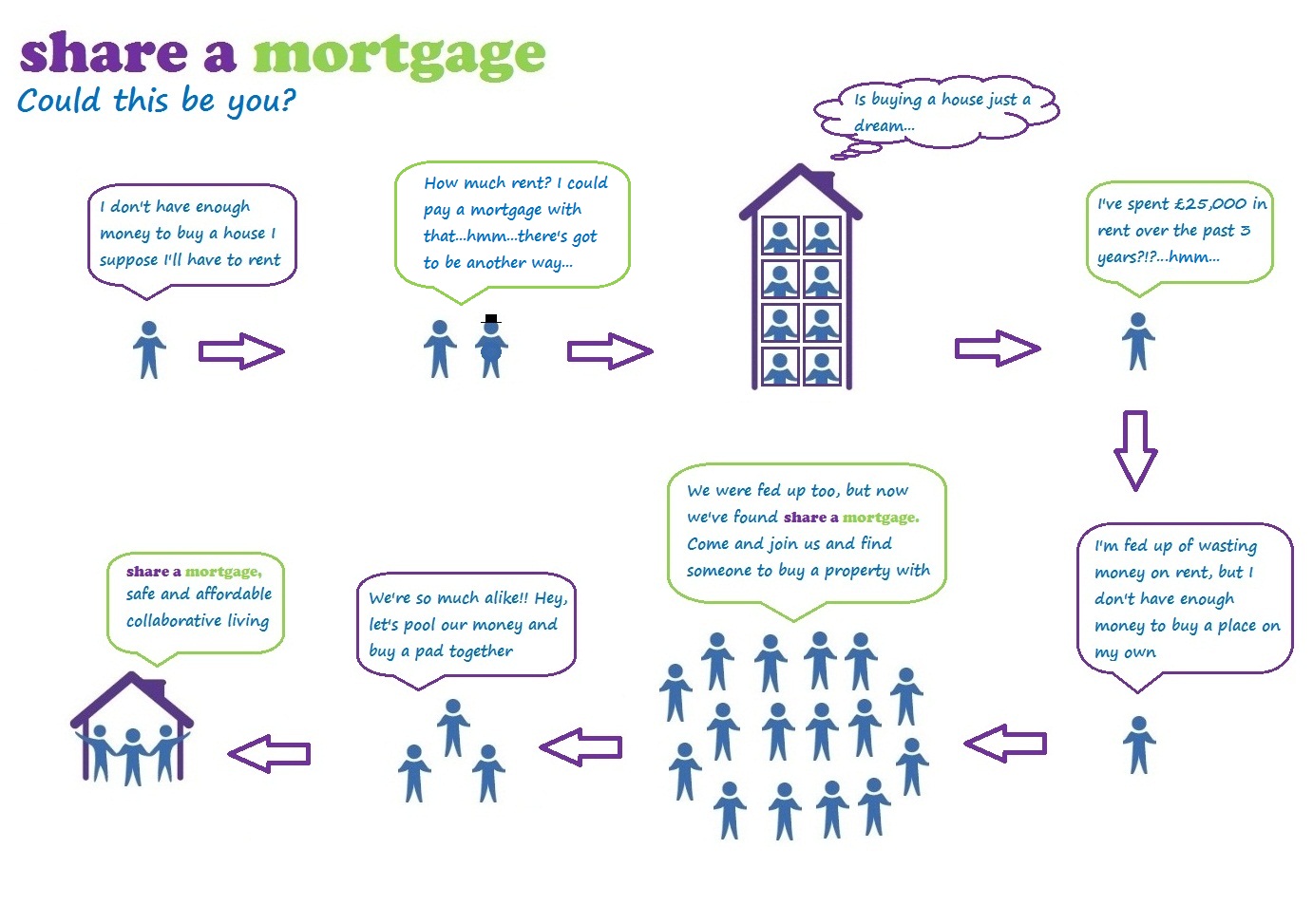

Rent or Buy...That is the question. Are you stuck renting? Do you want to buy your own home but can't afford it on your own?

Did you know we host a whole community of like-minded people who all want to pool resources so they can buy their own houses. You can meet people online whose house buying aspirations match yours, safely and securely. You then have the power to go for buying when you ask yourself that 'rent or buy' question.

Don't think you can't: yes you can!

Join Share a Mortgage

- just call 0333 344 3234

'To rent or to buy?'

To rent or to buy is a decision which, made properly, requires you to audit your financial and lifestyle affairs thoroughly.

In simple terms, you pay more money in rent for the same property than you would if you were buying it, but the extra money you spend in rent allows you to 'up sticks' relatively easily without the burden of having to sell your property. Buying a home often requires you to keep your income at a certain level for many years; your position becomes precarious if you are unemployed for long periods and are unable to make your monthly repayments. You can, however, lessen this risk by taking out income or mortgage protection insurance.

That said, there are a huge number of positives in favour of buying rather than renting. You have to save up a deposit and secure a mortgage (in most cases) but afterwards, much of the money you spend in mortgage repayments eventually converts to equity which you then own. Once the mortgage has been paid off, you can live rent-free and dispose of your home as you wish, leaving it, for example to your children. If house prices rise, you might make a capital gain if you sell up. And for many, particularly in the UK, owning your own home is irreplaceable in making you feel independent: many feel that you are best placed for example to marry and/or have children if you are a home owner.

Buying with others - reduce costs and risks

Not only does sharing a mortgage to buy a home with others often give you the option to buy which you would not have had if you tried to on your own, but it also means that the risks and costs of buying are reduced.

You can save up the necessary deposit to get a mortgage more quickly with others. Mortgage repayments become less when you share them, as do household bills. If you add into the mix a water-tight joint ownership agreement such as

Shared Ownership Protection

then you can also be assured that each sharer's stake in the property is set down officially and protected.

One picture explains these ideas better than a few hundred words; please look at the folllowing graphic: