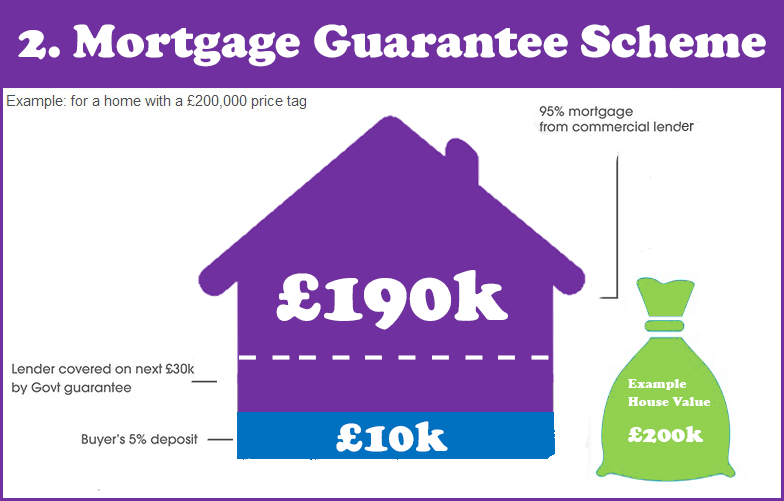

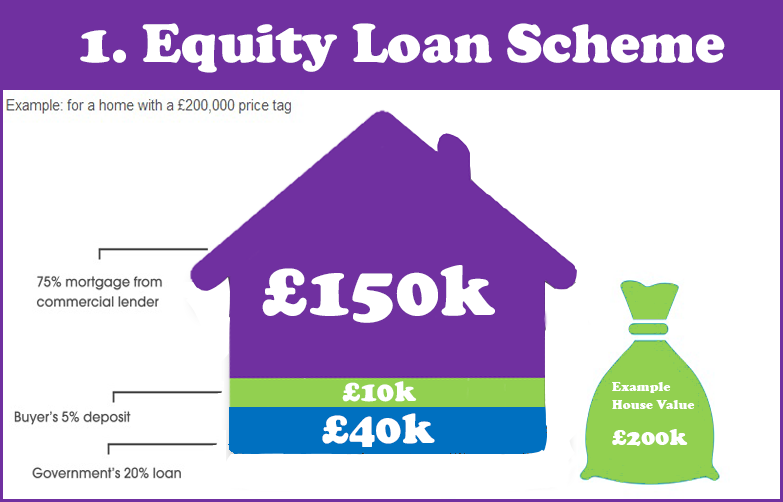

You normally have to have saved 10% of the selling price of a house you're looking to buy as a deposit, but the Government's Help to Buy initiative means that you can now do this with just a 5% deposit.

This means that you may have purchasing options in Higham Hill, Walthamstow or Leyton or anywhere in Greater London, but you should check to see if you are eligible first.

You should also instruct an experienced Help to Buy conveyancing solicitor to help you with the legal side of your move, because the conveyancing involved is more complex than for a standard transaction.

Get your free, fixed fee quote for our experienced Help to Buy solicitors, call 0207 112 5388.

This means that you may have purchasing options in Higham Hill, Walthamstow or Leyton or anywhere in Greater London, but you should check to see if you are eligible first.

You should also instruct an experienced Help to Buy conveyancing solicitor to help you with the legal side of your move, because the conveyancing involved is more complex than for a standard transaction.

Get your free, fixed fee quote for our experienced Help to Buy solicitors, call 0207 112 5388.

The Government’s Help to Buy initiative in Higham Hill allows eligible people to buy properties with as little as a 5% deposit.

The Government’s Help to Buy initiative in Higham Hill allows eligible people to buy properties with as little as a 5% deposit.