This article addresses how to improve your credit score. There are various credit agencies that hold information relating to your credit history. Mortgage Lenders and other lending companies; use your credit history to assess your viability and risk profile for credit. The better your credit file, or the higher the score, the more likely you will pass this part of the application process. The two main credit agencies are Experian and Equifax.

Your credit report gives a summary of your credit history, so it’s important to ensure that the data and information on it is accurate, up-to-date, and reflects your present circumstances.

For more detailed information, our 7 step guide on how to improve your credit score is a must read!!!

Improve your credit - Sorry, computer says no!#!

Even simple discrepancies on your credit report, such as different ways of listing your name and address, can make a difference. Mortgage lenders will review the information they have about you and compare it with your credit file and if they find even the smallest of differences in your credit report, then your application could be rejected; especially as these checks are predominantly done by computers – a definite computer says no approach!

It’s important to plan ahead if you are thinking about getting a mortgage. You need to know what your credit score is, not only to understand how much credit you could afford to borrow and the type of deal you might get, but also to ensure your credit history paints the best possible picture of your circumstance before you make your next mortgage application. To help ensure accuracy, it is sensible for all of us to review our credit reports on a regular basis and to make amendments where appropriate.

3 Simple steps could boost your credit score

1 - Don’t miss your monthly credit payments

- Your credit report can show you if you’ve missed any payments on cards or loans you have. Mortgage Lenders look for proof that you’re a reliable and responsible borrower, and given that late or missed repayments stay on your credit report for at least six years, it’s not hard to see how important it is to stay on the right side of repayments. You should stay within the agreed credit limits, and always make your repayments on time, - though if you accidentally do miss one, you can explain it by adding a "notice of correction", which is a statement of up to 200 words. A notice of correction is fine if a human is reading it, but remember a computer won’t understand that your car broke and you needed to get it repaired, all it see is a missed payment.

2 - Look out for accuracy

- Check your credit report for discrepancies such as different ways of listing your address, or errors such as duplicate listing of accounts or closed accounts marked as open. Should you find anything that isn't accurate, then contact the relevant lenders to get it altered. Watch out too for unfamiliar or suspicious entries in your credit report that could indicate identity fraud, and financial associations (eg: to an ex-partner) which are no longer relevant. Your credit report also shows Electoral Roll data that helps to prove your home address and that you are who you say you are.

3 - See what behaviour impacts your credit rating

- If you have made a lot of credit applications in a short space of time, mortgage lenders could believe that you’re in financial difficulties, or even see it as a sign of fraud. Your credit score helps you and your mortgage lender understand how your personal credit history could be interpreted. It’s a guide to help you understand your credit report, and how past credit management can impact on future credit applications, and for you to monitor your progress as you get your finances in order before you apply.

Turn a bad credit report into a good one in 7 easy steps

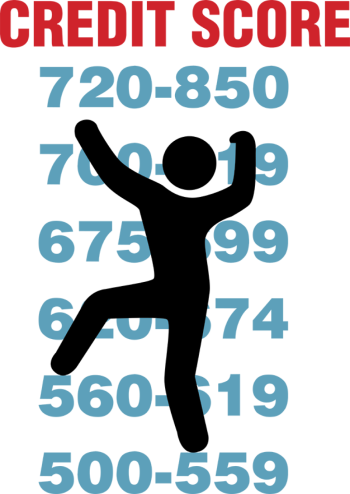

When you get your credit report you will see a summary score and a graphic indicator ranging from 1 (Very Poor) to 1000 (Excellent). Don’t be fooled thinking that a Good score will definitely mean you will get credit from a mortgage lender; it is even harder if you have a poor rating.

If you have a poor credit rating or simply want to know how to make your credit score even better you can follow our 7 easy steps . The process is simple and you can potentially make a massive impact within just 30 minutes.

Author Summary

Mortgage lender restrictions get tougher as of the 26 April 2014 with mortgage lenders reviewing salary multiples, affordability and more detailed credit checks. Even credit scores of 900 and above are no guarantee that your mortgage application to be approved.

Making sure you are everything in order before you apply for a mortgage is important, because if you get turned down by one mortgage lender, that’ll leave a mark on your credit file for all other further mortgage lenders to see.