News Articles

I'm a First Time Buyer, can I get a mortgage?

A mortgage is a massive commitment and for a first time buyer it can feel like very scary uncharted waters. This guide is aimed at first time buyer mortgage applicants and takes you through everything you need to do to get to have your own mortgage.

Step 1 – Mortgage Affordability...

11/12/2018

Can paying rent on time boost your credit score for buying a home?

So you've got an aspiration to buy your first home. Perhaps you've already found somebody to share with and you're busy saving away. You know that your credit score and report is important to mortgage lenders. Why on earth aren't your regular, timely rental payments, given how expensive they are,...

03/12/2018

Mortgage Sharing? Use an Independent Mortgage Broker

Firstly, hearty congratulations to anyone reading this who can buy or has bought a home without a mortgage! You are one of the lucky few rather than the many. Most people, however are going to need the assistance of a mortgage to buy a home because pooling resources only gets you so far....

03/12/2018

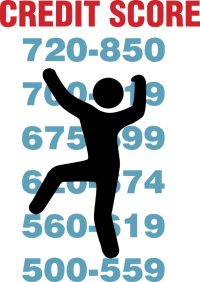

How Does Your Credit Report Work

Before a Mortgage Lender will agree to lend to you a penny they will first go through some checks. The 2 key checks are:

a) affordability; and

b) credit check.

If you get turned down because of your credit rating by one mortgage lender, it is possible that another mortgage...

01/11/2017

Improve your mortgage affordability

Cut your personal expenses to a minimum

Pay off any outstanding debts where possible, particularly bank overdrafts and credit card debt.

Do not use any payday loan service - the interest charged is astronomical.

Shop around for the best deals and use sites such as...

04/10/2017

Student Accommodation: What happens when you have to leave?

Once you've given back your cap and gown after graduation and tidied up your student accommodation, have you considered where you’ll be living next? Many graduates face little option but to return home while they take stock and search for their dream job. Sadly, all too often the time...

15/08/2017

Share living costs after buying your home

Share living costs after buying your home

The costs of living in a property are often forgotten during the conveyancing process and it is only after the bills start coming in that the true costs of buying a home are realised. The Money Advisory Service states that the average mortgage repayments...

03/08/2017

Free credit report - boost your home buying prospects!

You can easily obtain a free credit report which gives you credit information that a lender uses to decide whether to grant you a mortgage. Simply visit any of the websites of Experian, Equifax or CallCredit and follow their instructions.

You face an awful shock if you apply for a mortgage which...

12/03/2015

Share a Mortgage's 7 tips for comparing mortgage products

Comparing Mortgage Products - Share a Mortgages 7 Top Tips!

It is tough to compare mortgage products side by side when none of them seem to offer the same thing. In fact, it is often what they don't say they offer which you'll need to know in order to compare 'Apples with Apples'! If you need...

18/09/2014

Share a Mortgage's 12 'Real World' First Time Buyer tips

If you are a first time buyer intending to take your first step onto the property ladder, congratulations! You CAN do it, but you need to do many things to give yourself as much chance as possible. It's all about planning, preparation and above all, keeping a cool, realistic head. With that in...

16/09/2014

5 Tips for First Time Buyers trying to save a mortgage deposit

For first time buyers, the idea of saving possibly tens of thousands of pounds for a deposit for a mortgage for buying a house is understandably mind-boggling. Even saving a minimum 5% deposit for, for example, a property valued at £150,000 would amount to more than £9,000.

This article examines...

03/09/2014

How to improve credit score

This article addresses how to improve your credit score. There are various credit agencies that hold information relating to your credit history. Mortgage Lenders and other lending companies; use your credit history to assess your viability and risk profile for credit. The better your credit file,...

23/04/2014

What types of mortgages are there?

There are two main types of mortgage:

Repayment– you repay both the capital (the money lent to you) and the interest charged on it each month, until you have repaid the full loan at the end of the term.

Interest only– you only pay the interest on the loan each month, so your debt stays the...

25/02/2014

Five reasons to get on the electoral roll for first time buyers

With the next general election most likely little more than a year away (2015), the leading names are jostling for position ahead of the expected 2015 date. But many of us won’t even be able to vote in it, unless we get on to the electoral roll – and not doing so could also affect your credit...

19/02/2014

SAM in the Media