All experts agree that the UK suffers a chronic undersupply of houses which is now forcing property prices up and to stratospheric levels in London and the South East.

In life, as indeed in the housing market, there are always solutions, and Share a Mortgage is working at widening home ownership for all.

However, the problems faced, particularly by first time buyers, but most property buyers in general, are real and resilient. Home ownership is declining - from a peak of 70.9% in 2003 to around 64.8% in 2014 (Office for National Statistics) - and according to some projections, may fall as low as 50% by 2034.

The main problems:

- Undersupply of houses causing inflated property prices

- Continuing rapid growth in UK population

- Speculation in the housing market

- Average earnings not in line with increases in property prices

- Tighter mortgage restriction

What house can an average earner buy for less than £100,000?

The ONS has released figures that an average UK worker earns £26,052 per year (June 2016).

On a four times salary mortgage, this could give a single person a mortgage of £104,208. The average property price in the UK is now £213,927 (Land Registry June 2016). This clearly leaves many average earners shut out of the property market.

How did we get here?

The UK's population has increased markedly in the last 44 years. In 1960, there were 52.4m people but by June 2016 there were 65.1m (Office of National Statistics).

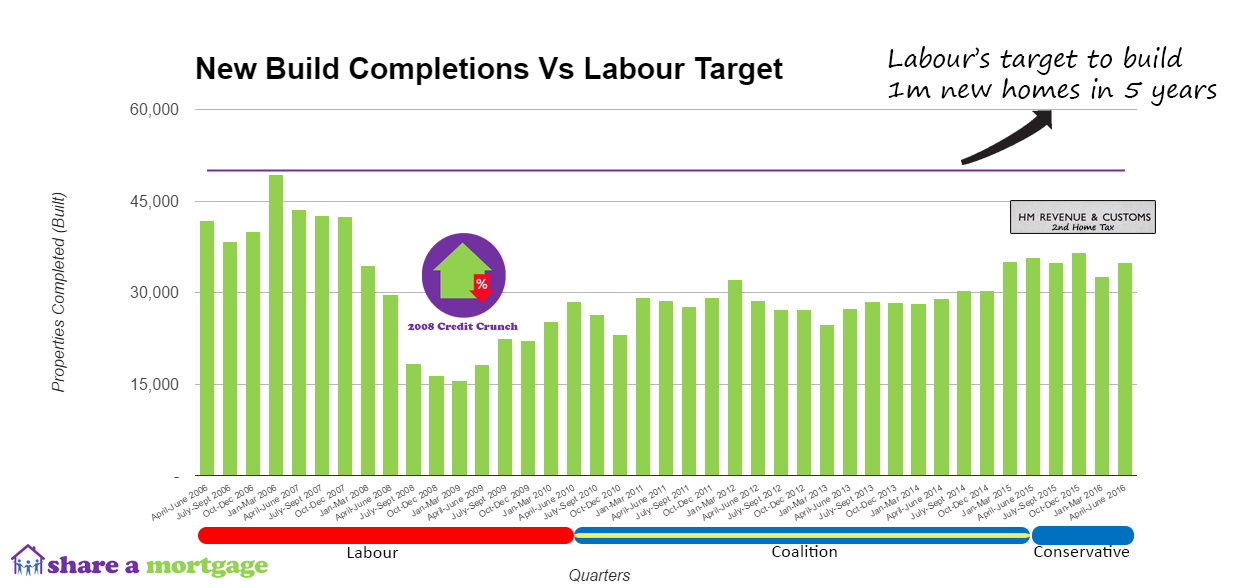

The house building rate, where it had been around 300,000 new houses every year in 1971, declined to 150,000 in 1991. To sustain the current demand for houses, the Royal Institute of Architects recently stated that 300,000 houses per year would need to be built. In 2015, only 142,890 houses were built, a shortfall of more than 155,000.

Labour under Jeremy Corbyn made a pledge to create 1 million new homes in 5 years, some 200,000 per year on average or 50,000 per quarter. If this was achieved for even one quarter, it would be a better result than at any time in the decade which preceded the pledge, given in August 2016.

London: 73% of new-builds bought by overseas investors

The lack of available properties has been exacerbated in recent times by the increase in overseas investment in the buy to let market. In fact, in the last two years to February 2014 only 27% of homes in Central London were bought by UK nationals and more than half were sold to residents of Singapore, Hong Kong, China, Malaysia and Russia, according to Civitas.

In a market where there are not enough properties being built to cope with demand already, these overseas investors are creating a further divide. Predominantly buying properties with cash alone, their financial clout vastly outstrips the average UK domestic house buyer. It has been estimated that in prime London property areas such as Mayfair and the West End, 55% of the property market revolves around non-EU buyers from Russia, the Middle East, India and Africa.

MMR tightened mortgage application conditions

The Financial Conduct Authority's (FCA) Mortgage Market Review (MMR) of April 2014 ushered in much tougher conditions regarding mortgage applications and a clear decline in acceptances.

From a different angle, as of October 2014, only 15% of a large (lending out more than £100m per year in total) mortgage lender's funds could be used towards mortgages exceeding 4.5 times annual salary. At the same time, lenders have had to stress test potential borrowers for their ability to withstand an increase in the Bank of England's (BOE) base rate of up to 3% and still keep up mortgage repayments. The BoE's Governor, Mark Carney, announced these conditions ostensibly to tackle growing consumer indebtedness, but the strictures, according to many experts, most negatively affect young, first time buyers in the capital.

What sort of effects is the problem causing?

Share a Mortgage commissioned a YouGov survey which found that a third of respondents felt 'stuck', i.e. trapped and unable to become independent, get married and have children because they could not buy property. Around a third despaired of ever being able to own their own home.

The survey questioned more than 2,500 people in the UK and found that over half of respondents (55 per cent) feared that the longer it takes to get on the property ladder, the harder it becomes. Meanwhile one in three (35 per cent) said that not being able to afford to buy a property prevents people from being able to consider other major life changes such as getting married or having children.

36 per cent said that being unable to afford to buy a property might make people feel ‘stuck in a rut’ and 32 per cent believed that people might feel like they have not achieved their life goals if they can’t afford to buy a home. In addition, 27 per cent said renters are not given the same standing in society as home owners.

Dr Rick Norris, Charted Psychologist and author of Think Yourself Happy, said, about these matters:

"One of the most deeply ingrained human needs is our need for safety and security. Knowing you have your own roof over your head links directly to this need and I understand why many individuals feel more anxious if they are living in rented accommodation. A landlord can choose to sell their property at any time, so as a renter you will never feel completely secure. Meanwhile, those who own their home naturally feel a greater sense of safety and security.

"It’s interesting that those who rent do not feel they have the same standing in society as home owners. The cost of rent every month often equates to the same as monthly mortgage repayments, so in terms of month-by-month outgoings, renters and home owners are financially equal. However, the financial difference is the deposit and associated costs required to buy a property. It is this lack of a deposit to buy a home that can make those who rent feel inferior to home owners."

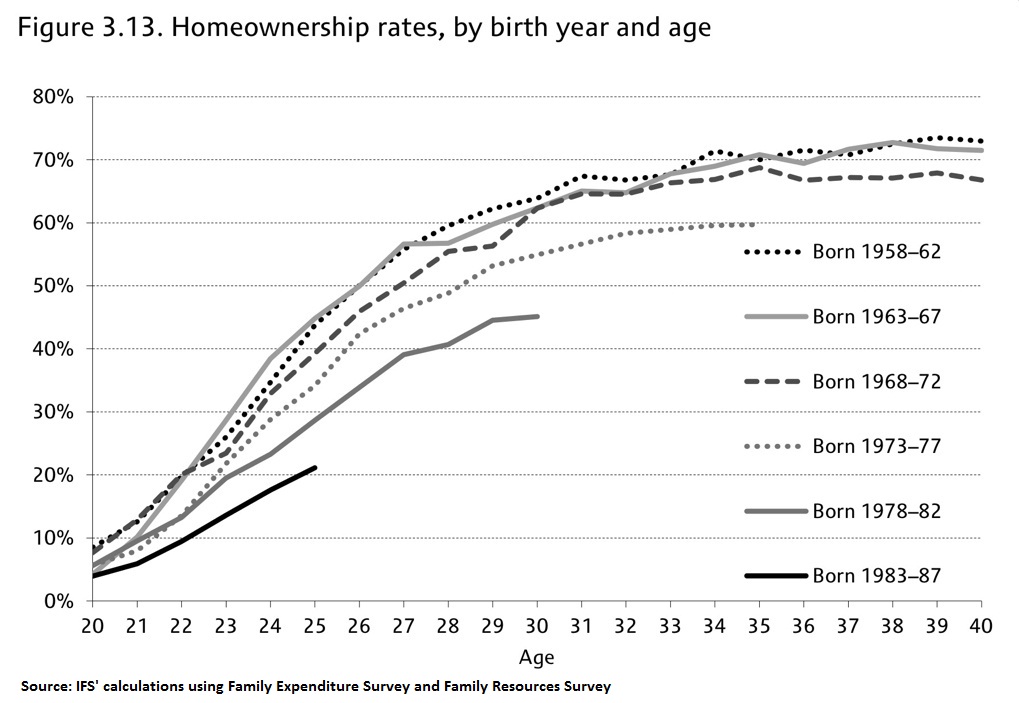

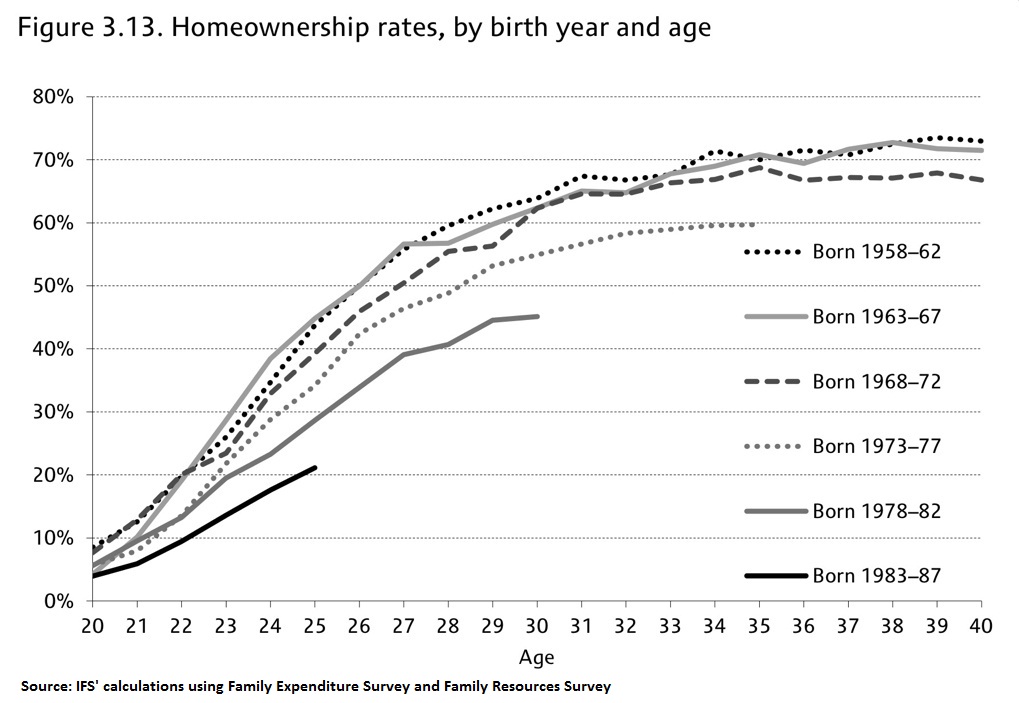

The graph above illustrates that in the UK, for those born between 1983-87, at age 25 a little more than 20% will own their own property. However, for those born between 1958-62, by the same age around 45% owned their own home, more than double the previous group.

Click below to find out about: