Once you've given back your cap and gown after graduation and tidied up your student accommodation, have you considered where you’ll be living next? Many graduates face little option but to return home while they take stock and search for their dream job. Sadly, all too often the time flies by and you find themselves unable to ‘fly from the nest’ as you are faced with the challenge of a tough job market, very little savings, huge student debt and escalating rental and home buying costs.

Don’t give up if you think your only affordable option is to live back at home with your parents – there are ways to broaden your accommodation options however they require planning. The starting point is always to look carefully at your own finances to budget how long it’d take to save up a deposit to rent, or even to buy your own home. You can easily do this using our Affordability Calculator to work out how much a month you can save and how long you’ll have to stay living with your parents before you’ll have enough money to move out.

If you are unsure about your next accommodation steps after graduating, we would be delighted to speak to you and advise you about your options. Just call 0207 112 5388.

Other than going home, what other options are there?

Some graduates go abroad, either to travel or to work or both (still faced with a delayed journey back to their parents upon their return). Others opt to stay and live in the location of their university. Others go for flat shares with friends or acquaintances in the locale of their jobs.

However over 50% opt to live with their parents to try and save the money on rent while putting money away towards their future rental tenancy or house purchase. Here’s how much you’ll need to save for both:

1. How much does renting cost?

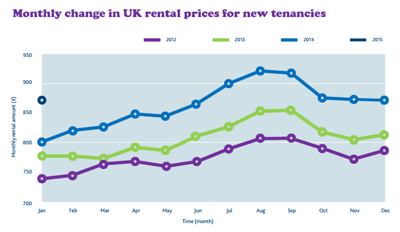

The cheaper of the two options is renting where the average tenancy requires an upfront deposit of anywhere from 4 weeks to 8 weeks deposit. The average rent in England is presently staggeringly high at £889pcm (£702pcm exc London) and in London it costs on average £1,412pcm (Jan 2015).

The price of 2 months' rent outside London is £1,778 on average. Add to this the typical arrangement fee of around £250 and a deposit costing a month's rent then the total amount you’ll be looking to save is £2,917. There are additional costs to factor in such as sofas, beds, TV, fridge, freezer and washing machine, which depending on if you are given these will add to the cost as well.

You can use our

Affordability Calculator

to budget how much money you have spare at the end of each month to put towards renting. If after all your spending you have £300 spare each month it would take 10 months before you could afford to move out.

Remember if you share renting with someone you reduce the costs!

2. How much does buying a house cost?

Now, you may be thinking that buying a home is completely unachievable; however planning how to afford buying your own home is something that unless you start, you’ll never achieve. There are even starter home solutions for first time buyers such as:

-

Help to Buy

– Buy with a 5% deposit

- Shared Ownership – Share the purchase of a property with a housing association owning as little as 25%

Both of these solutions support buying a home however you need to work out how much you can afford and how long it’ll take to save.

Using a good budget planner can support you in gauging how much you need to save and how long for. Our

Affordability Calculator

does just that.

Using a good budget planner can support you in gauging how much you need to save and how long for. Our

Affordability Calculator

does just that.

Are you going to be one of the 4m stuck living at home?

Most graduates are left with little option but to return home to their parents home before being able to rent or buy, which makes early planning on how to break away from the family nest very important. It’s estimated that there are around 4 million 18 to 34 year olds stuck living at home with their parents.

The good news about living at home is, when you've secured a job, you can start saving money towards a deposit, whether towards renting or buying a property: most parents don't charge market rental rates! It is never too early after graduation to take your first steps towards entering the property market. Your very first step is a thorough examination of your own finances, using our

Affordability Calculator

. You will also need to assess your credit history and examine what strategy suits you best but the rewards of home ownership are immense, once you've surmounted the considerable barriers to entry.